Homeowners Insurance in and around Summerville

Looking for homeowners insurance in Summerville?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Dorchester

- Summerville

- Berkeley

- Charleston

- Moncks Corner

- Saint George

- North Charleston

- Ridgeville

- Cottageville

- Cross

What's More Important Than A Secure Home?

After a stressful day at work, there’s nothing better than coming home. Home is where you recharge, chill out and laugh and play. It’s where you build a life with family and friends.

Looking for homeowners insurance in Summerville?

Help protect your home with the right insurance for you.

State Farm Can Cover Your Home, Too

From your home to your prized collectibles, State Farm has insurance coverage that will keep your valuables secure. Katelyn Aldridge would love to help you know what insurance fits your needs.

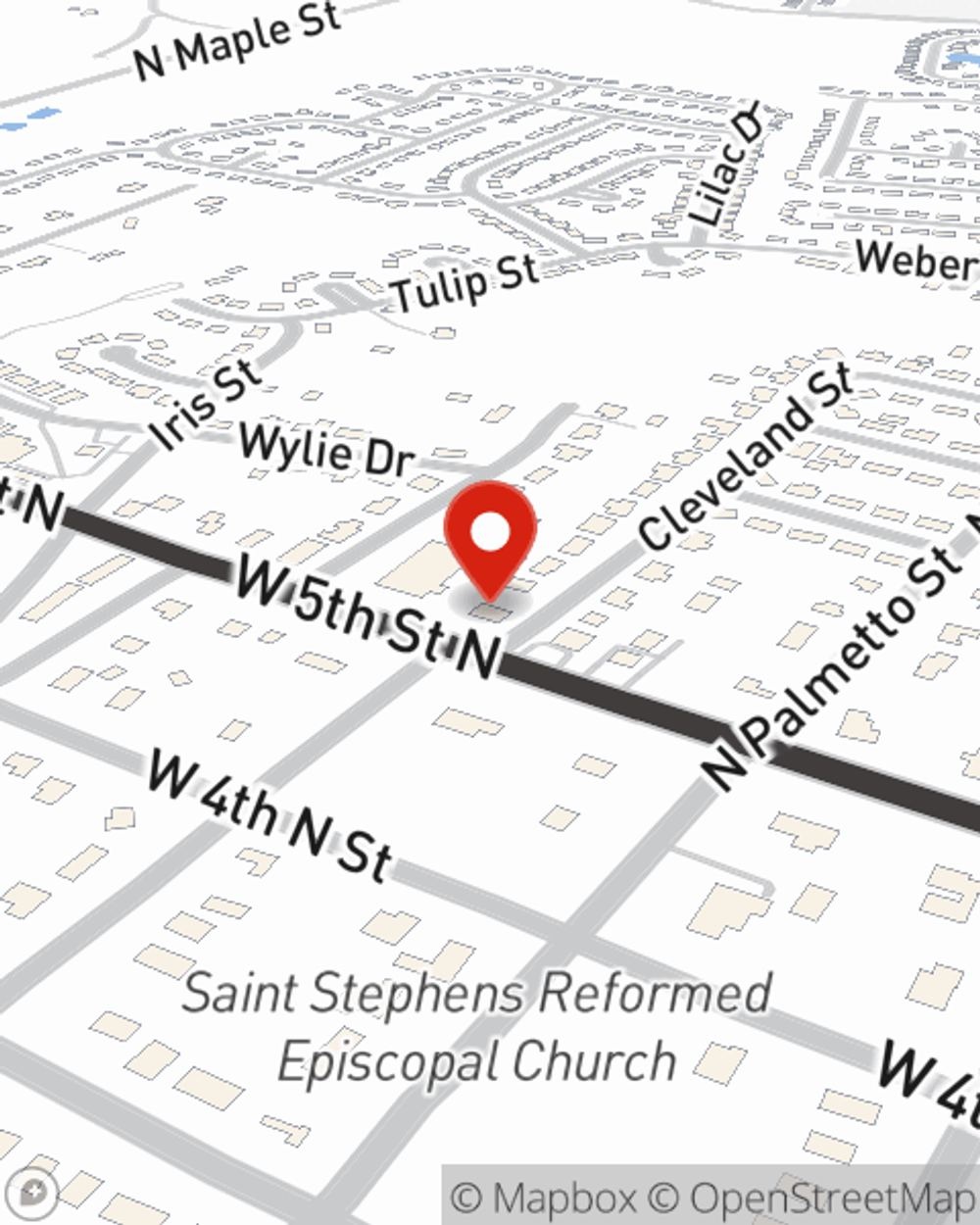

When your Summerville, SC, house is insured by State Farm, even if something bad does happen, your most valuable asset may be covered! Call or go online now and discover how State Farm agent Katelyn Aldridge can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Katelyn at (843) 419-6126 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

DIY pest management & wildlife control tips

DIY pest management & wildlife control tips

Mole, ground squirrels, and various other pesky critters can be difficult to get rid of. We have tips for rodent removal.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.

Katelyn Aldridge

State Farm® Insurance AgentSimple Insights®

DIY pest management & wildlife control tips

DIY pest management & wildlife control tips

Mole, ground squirrels, and various other pesky critters can be difficult to get rid of. We have tips for rodent removal.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.